How To Budget for a One Year Trip Around the World -- Or Any Extended Vacation!

Monday September 21, 2015 (Planning, Preparation)

TL;DR: If you want to start exploring right away, here’s a link to the spreadsheet You’ve decided to take a long vacation. One where you’ll be receiving little to no income along the way. You want to make sure your money lasts for the duration of your journey! That is, assuming you’re anything like me.

When Sandra and I decided we were going to do a one year trip around the world I immediately started worrying about how we could afford it all. I’ve always been a bit of a penny-pincher and I wanted to make sure we stayed within our means throughout the trip and didn’t overspend. So far we’ve managed to accomplish that goal fairly well! As of today, we’re 21 CAD over budget after eight months of travelling. Not perfect, but we’ve managed to do some pretty incredible things along the way so I’m proud of how well we’re doing.

During the planning stages for the trip, I went in search of budgeting tools to help us out. I looked at a bunch of Android and iPhone apps but didn’t really find anything geared directly towards the style of our trip. That’s not to say that there’s nothing else appropriate out there – there likely is. But I’m a programmer. So I made my own. It’s nothing too fancy – just a Google Spreadsheet. But it has a lot of positive aspects:

- It’s free

- I can share it with you

- You can share it with anybody travelling in your party to edit along with you

- You can work on it offline if you don’t have Internet access

The key to this spreadsheet is that it assumes you have zero income. That’s the biggest difference between this and 90% of bog standard “budgeting” apps. The zero income assumption is most definitely in play for us – we’re not working at all on our trip, and as a result our bank account balances follow a disturbingly straight line directly towards zero. When I was planning the spreadsheet I knew that there would be a lot of key information I wanted to have at my fingertips during the trip. For instance, I wanted to ask questions like these:

- How much money have we spent so far?

- How much money per day are we spending on average?

- How much money did we expect to spend by this date?

- How far have we deviated from our planned spending?

- How much money do we have left to finish the trip?

- Given our current average spending, how long could we keep travelling before spending the entirety of our budget?

- How many days do we have to spend nothing in order to get back on track with the budget (assuming we’ve overspent)?

- How much did we spend today in my home currency?

- How much money do we have left to spend today in my home currency?

This spreadsheet answers all of these questions for you. And I think it requires about the minimum amount of effort to update it. So let’s take a walk through it, shall we? Follow along using the spreadsheet here. If you find the spreadsheet useful, you can just copy it and start playing around with it yourself! This is home base. It’s where you check in on how you’re doing. This is where all of those questions I posed earlier get answered. To start off using the spreadsheet, there are only a couple of steps.

- Check the Detected Currency This will be your “home” currency. At the end of the day, everything will be converted for you into this currency by the spreadsheet. This keeps it simple. You’re probably not trying to track how much you’ve spent in Maldivian Rufiyaa. You’re just examining everything in a currency that makes sense to you. Currently, everything is set up to have Canadian Dollars (CAD) as the “home" currency. If you’d like to change it to another currency, keep reading.

- The Start Date This is the date that you plan on starting your trip. Set it to whatever you’d like.

- The End Date This is the date that you plan on ending your trip. You don’t necessarily have to end your trip, but it’s used to calculate things like how much you are able to spend per day. After setting a start and end date, you can already see how many days your trip will be by looking at the “Total Days” box. Fun!

- The Budget This is the total amount you want to spend over the course of the trip. It should be in units of your “home" currency.

On this sheet, you should only be manually changing the Start Date, End Date, and Budget entries. That’s why they’re green and have a dark box around them. Everything else will be calculated for you. All currency values are in units of your home currency. Again, we’ll explain how to change that later.

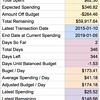

Here’s an explanation of the remaining entries on the sheet:

- Budget at Current Spending How much you’ll spend over the course of your entire trip assuming you maintain your existing average daily spending.

- Total Spent How much money you’ve spent on the trip thus far. It’s just the sum of all of your transactions converted into your home currency.

- Expected Spending How much money you expected to spend by this date. The expected spending per day is the length of the trip divided by the total budget. This expected spending is just your daily budget multiplied by the number of days into the trip you are.

- Amount Off Budget The difference between the total amount spent and the expected spending. If it’s negative, that’s great -- it means you’ve spent less than you expected to at this point in the trip! Buy an extra beer tonight!

- Total Remaining The total budget minus the total amount spent. This is how much money you have remaining to finish the trip.

- Latest Transaction Date This is the most recent transaction date. Generally it represents “today” while you’re on the trip, but it’s based on the date of the latest transaction entered in the Spending sheet. We’ll talk about the Spending sheet soon.

- End Date at Current Spending A projected end date based on your current average daily spending. It could be longer or shorter than your desired trip. If you’re spending less than you expected, this projected end date will be after your desired end date. That’s great -- you can travel longer than you thought! If you’re overspending, this date will estimate the time at which you’ll use up your entire budget.

- Days So Far How many days you’ve spent on the trip so far. It’s calculated as the latest transaction date minus the given start date of the trip.

- Total Days The total number of days your trip is expected to last. This is just your given end date minus your given start date.

- Days Left How many days you have left on the trip. Calculated as the total days on the trip minus the days you’ve spent so far.

- Days Until Balanced Budget If the number is positive, it represents how many days you have to spend zero dollars to get "back on track”. If the number is negative, it represents the number of days you could spend double your allowable budget and still stay within your overall budget.

- Budget / Day Your daily budget. This is just the total trip budget divided by the total number of days in the trip.

- Average Spending / Day How much you’re actually spending each day. Ideally you keep this value less than the daily budget.

- Adjusted Budget / Day How much you can spend per day going forward from today and still remain in budget. If you’ve been overspending, this adjusted budget will be less than the budget per day. If you’re underspending overall, congratulations -- this is your new daily budget!

- Latest Spending The total amount of money you spent on the latest transaction date. It’s all been converted into your home currency. The individual transactions are shown under Latest Purchases where they’re also converted into your home currency one by one.

- Latest Remaining How much money you have left to spend today. This is your adjusted daily budget minus your latest spending.

This is where you enter everything you spend money on! It’s pretty straightforward. Just add a row and enter the date, amount (in whatever currency you paid in!), the currency you used (a three letter code representing the country’s currency), and an optional comment describing what the expense was for. That’s it.

This is your only ongoing work – adding in expense lines as you spend money. I tend to keep track of expenses on my cell phone as a small note. Each evening, I transfer the expenses into the spreadsheet. It only takes a couple of minutes at most. Then I check in with the Budget sheet to see how we’re doing. It works, I promise!

These entries are quite important: they represent the exchange rate you’d like to use to convert each currency into your home currency.

To start with, you should have an entry for your home currency with a Rate of 1.0. Simply, any money you spend in your home currency should be multiplied by 1.0 to be converted into your home currency. Pretty obvious.

The remainder of the rates are pretty flexible. My approach is the following:

- Get the three-letter currency code for the country This is generally pretty easy. For instance, in Myanmar just type “Myanmar currency” into Google. After just a bit of searching, you’ll see that the currency code is MMK.

- Get the exchange rate to your home currency Let’s say your home currency is CAD. Go to google.com and type: “1 MMK in CAD”. It should show you the currency exchange before any search results. If it doesn’t, make sure you’re not on some Google subdomain like google.com.mm. Copy the equivalent value shown there in your home currency. For “1 MMK in CAD”, the appropriate number is “0.0010” at the time of writing.

- Enter the rate into the Rates sheet Now you just add the new conversion rate! For the “Code” enter the source currency (MMK, in our example). Under the “Rate” column, you can directly paste the rate from Google. However, I’m more pessimistic. I end up pasting in a formula like this: =(paste_original_rate_here) * 1.1

In other words, I add another 10% on to the rate. This generally covers any swing in exchange rate while we’re travelling and makes sure we don’t underestimate the amount of money we’re spending. It can also cover exchange rate losses the bank will charge you when you spend money in a foreign currency on a credit card, for instance. If you want to change a rate for a currency at a later date, it’s no problem: all of the corresponding entries will automatically be recalculated and your Budget sheet will respond accordingly! We’re all done. So what are you waiting for: click here to get started! You too can budget with the pros. If I’m the pro. Which I like to think that I am. If you have any questions about how to use the spreadsheet or its inner workings, please feel free to contact us! One annoying bug seems to crop up from time to time in Google Sheets. The “Latest Purchases” seems to get confused and carry over purchases from old dates. Everything else appears correctly on the Budget sheet, but you will see purchases sitting around from previous days. If this happens, just delete all of the Latest Purchases columns from row 3 downward. Make sure to leave the first purchase in row 2 since that’s where the formula resides! Your purchases for the latest transaction date will immediately reappear, and the old purchases will be gone. I think the bug is related to switching between offline and online modes while working on the spreadsheet, but I’m not sure.